How to Transfer Provident Fund (EPF) Online from one P.F account to another.

The EPFO or Employees' Provident Fund Organisation has introduced an online system to facilitate transfer claims and withdrawals by its members. Using this system, an employee can transfer his or her provident fund (EPF) balance with the previous employer to a new employer or can make partial/complete withdrawal of his PF balance with ease. In online transfer of PF, an employee has the option to get his or her claim attested by the current or the previous employer. After you submit your EPF transfer request, the employer will verify/correct your member details, approve and submit the request online through the portal. However, the employer needs to have a digital signature in order to effect the transfer. There are certain eligibility criteria which an employee needs to meet in order to transfer the EPF online.

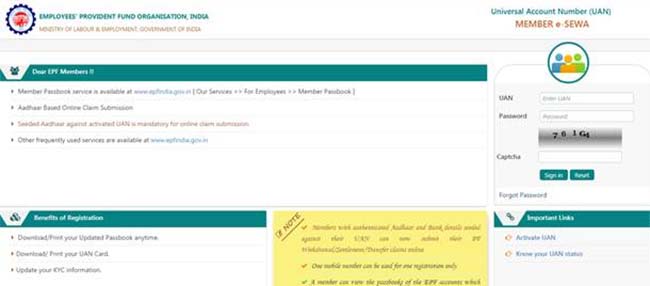

1) Log in to the E.P.F.O members' portal using your UAN and password.

4)

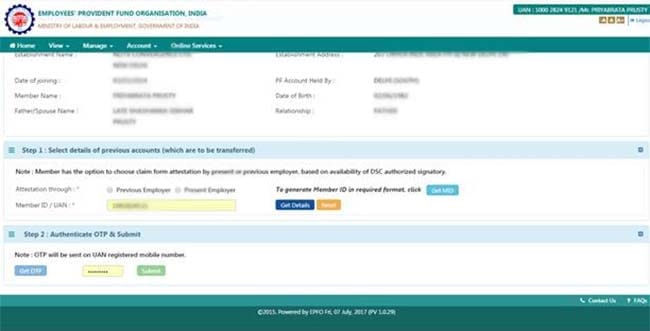

Once you verify your personal details, go to Step 1 where you need to

provide the details of the previous employer. But before that you need

to select the option - previous employer or present employer - through

which you want to do the claim form attestation.

5) After you

fill in the details of previous employer and submit, an OTP will be sent

to your registered mobile number. Once you authenticate your identity

by entering the OTP, the request will be submitted and an online

filled-in form will be generated. You need to sign the form and send it

to your present or previous employer.

6) The employer will also

get an online notification about the EPF transfer request. After

verification of your employment details, the employer can digitally

forward the claim to the EPFO office, which will process the claim.

7)

After you submit the online request, you can check the status of your

EPF transfer claim under the 'Track Claim Status' menu, which is under

the 'Online Services' menu.

1) The member should have activated his Universal Account Number (UAN) and mobile number used for activating UAN should be in working condition.

2) Member's Aadhaar details should be seeded in E.P.F.O database and he/she should have access to OTP-based facility for verifying eKYC from UIDAI while submitting the claim.

3) Member's bank account along with IFSC code should be seeded in E.P.F.O database.

4) Permanent Account Number (PAN) should be seeded in E.P.F.O database for PF final settlement claims in case his/her service is less than 5 years.

If you meets the above requirements, then he/she can go ahead for online claim submission.

Here is how to do it:

1) Log into the member interface using your UAN and password.

2) Go to the 'Manage' tab and select 'KYC' to check that details like Aadhaar, PAN and bank account details are available and are correct.

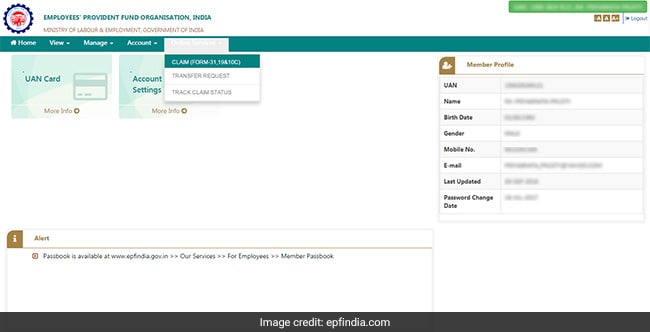

3) If you are satisfied that all details are available and are correct, then go to the 'Online Services' tab and select 'Claim' from the dropdown menu.

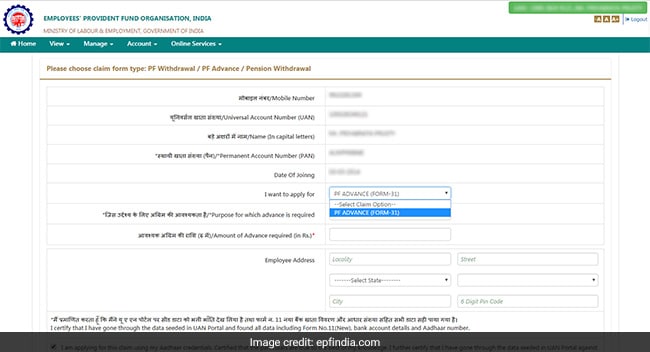

4) On the 'Claim' screen you will find all your member details, KYC details and service details and below that, you will find 'Proceed For Online Claim' tab. Click on the tab to submit your claim form.

5) In the claim form, select the kind of claim you want to submit like P.F. withdrawal , P.F. advance or Pension withdrawal, under the 'I Want To Apply For' tab. If you are not eligible for any of the services like PF withdrawal or pension withdrawal, due to the service criteria, then that option will not be shown in the drop-down menu.

After you select the relevant claim, a detailed form will be displayed. Fill the form and authenticate using Aadhaar OTP to complete the online claim submission.

After you submit your claim, you can check your claim status by selecting the 'Track Claim Status' tab, under the 'Online Services' menu.

No comments:

Post a Comment